DO YOU NEED TO FILE A PERSONAL TAX RETURN, AND WHAT IF YOU DON’T?

In our previous post on LinkedIn, we shared that the earliest date personal tax returns can be filed is February 24, 2025. Do you need to file this return? What are the implications if personal tax returns are not filed, or filed late?

Every individual who is a resident of Canada needs to file a personal tax return. However, this is easier said than done! What exactly is the definition of a “resident of Canada”? It’s important to distinguish this from the legal status of residency. The definition of “resident of Canada for tax purposes” is different and requires a more thorough analysis. At the very least, individuals who are Canadian citizens, permanent residents, temporary residents such as individuals with a work permit, and have a SIN must file a personal tax return. Other scenarios may require a one-on-one analysis.

A common misconception is that if you didn’t earn income, you don’t need to file a tax return. However, according to the CRA (Canada Revenue Agency), all residents of Canada are required to file their tax return, regardless of their income level.

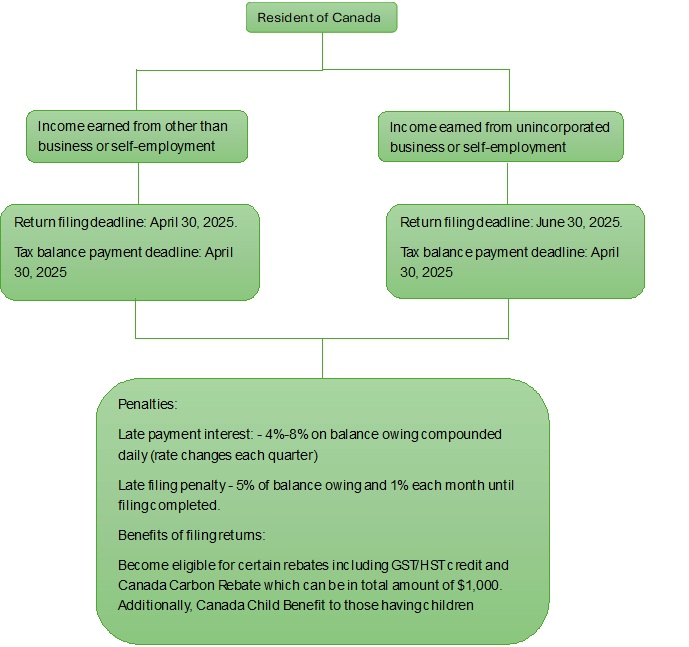

Filing and Payment Deadlines:

- Personal tax return filing deadline: April 30, 2025

- Personal tax return filing deadline for self-employed individuals (if your business was not incorporated): June 30, 2025

- Deadline to pay taxes if you owe (regardless if you are self-employed or no): April 30, 2025

Interest and Penalties for Late Filing or Payment:

- Interest rate: 4% – 8%, calculated on the balance due after the deadline and compounded daily.

- The interest rates are based on prescribed rates and may change each quarter

- In addition to the interest calculated on the balance owing after the payment deadline, if the return is filed late (after April 30, 2024), the penalty is 5% of your 2024 balance owing, plus an additional 1% for each full month the return is filed after the due date.

Other Implications:

- Failing to file a personal tax return or filing late is a non-compliance issue with the Canada Revenue Agency, which can result in unfavorable consequences in the future.

- If you don’t owe any taxes, failing to file your return means losing the opportunity to claim certain credits/rebates. These benefits can include, but are not limited to, the GST/HST credit, Canada Carbon Rebate (which can total about $1,000), and the Canada Child Benefit (if you have children).

Given the potential penalties for late filing or unpaid taxes, as well as the benefits you could miss out on by not filing, it’s essential for every resident of Canada to submit their personal tax return on time.

We provide a streamlined and hassle-free process for filing your tax return, starting with a easy to follow checklist, a secure document upload portal, and expert guidance to ensure your return is accurate and complete. Let us help you navigate this tax season with confidence!

By: Chaitali Patel Professional Corporation

Contact:

Email: connect@chppc.com

Website: www.chppc.com

Follow us on LinkedIn for similar tax and accounting updates – https://www.linkedin.com/company/chaitali-patel-professional-corporation

Chaitali V Patel

Founder

Chaitali Patel Professional Corporation